About Tally ERP 9.0 Training

Why Tally.ERP 9 ? Asking this question to any enterprise is like asking farmer why he needs rain. Tally has grown from a financial account package to a multifaceted Enterprise Resource Planning Software. With over 90% of business in India using tally.ERP 9 there is a acute shortage of People having accounting and complete Tally Skills.

Tally is highly recommended for a person who is interested in accounts. If your background is in the field of accounting then with the help of Tally ERP 9 you can land up with a good job. Job opportunities for tally is always in demand.Tally ERP 9 helps a student to learn all about accounting which includes Balance Sheet, Trial Balance, Ledger entries and so on. Its not necessary that a person should have a background of accounting in order to learn Tally, Tally can be opted by anyone who has the required interest in this software. As a Tally Certified Professional, you have ample opportunity to choose the industry you wish to work in and the place, as these opportunities exist across the world.

TALLY ERP TRAINING HIGHLIGHTS

Course Duration

1 Month

(4 Months course and 2 months Project)3 Months

(Basic Tally, Advance Tally and Tally.ERP)4 Months

(Basic Tally, Advance Tally, Tally.ERP, Admin and Configuration)Learners

50000

Delivery Mode

Classroom Training

Apply Online

TALLY ERP COURSE OUTCOME

TALLY ERP9 TRAINING COURSE CURRICULUM

Basics Of Accounting

Accounting Principles

Accounting Principles  Concepts and Conventions

Concepts and Conventions Mode of Accounting

Mode of Accounting Recording Transactions

Recording Transactions Financial Statements

Financial Statements

Features of Tally. ERP 9

Features of Tally. ERP 9  Creating Accounting Master

Creating Accounting Master Creating Inventory Masters

Creating Inventory Masters Inventory Vouchers

Inventory Vouchers  Invoicing

Invoicing

Advanced Accounting

Bill Wise Details

Bill Wise Details Cost Centres and Cost Categories

Cost Centres and Cost Categories Voucher Class

Voucher Class Multiple Currencies

Multiple Currencies Bank Reconciliation

Bank Reconciliation Budget and Controls

Budget and Controls Scenarios Management

Scenarios Management

Service Tax

Service Tax TDS and E-TDS Returns

TDS and E-TDS Returns TCS and E-TCS Returns

TCS and E-TCS Returns Excise of Dealers

Excise of Dealers Excise of Manufacturers

Excise of Manufacturers

-

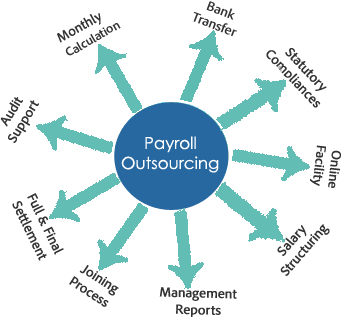

Payroll Accounting and Compliance

Payroll Accounting and Compliance  Configuring Payroll

Configuring Payroll Payroll Masters

Payroll Masters Processing Payroll

Processing Payroll Employer PF Contribution

Employer PF Contribution Employer ESI Contribution

Employer ESI Contribution Payment of PT

Payment of PT Payroll Reports

Payroll Reports

Order Processing

Order Processing Reorder Level

Reorder Level Tracking Numbers

Tracking Numbers Batch Wise Details

Batch Wise Details BillofMaterials

BillofMaterials Stock Valuation Etc

Stock Valuation Etc VAT configuring

VAT configuring Computing,Reports

Computing,Reports CST configuring

CST configuring

Tally Vault

Tally Vault POS

POS Job Costing

Job Costing Multilingual Capabilities

Multilingual Capabilities Security Control

Security Control Tally Audit

Tally Audit ODBC

ODBC Online Help and Support

Online Help and Support

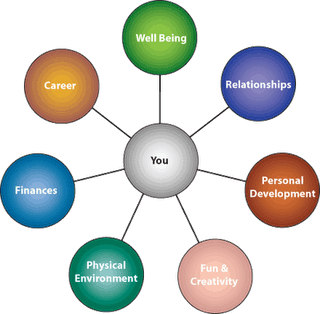

Payroll Accounting and Compliance

Payroll Accounting and Compliance Time Management

Time Management Goal Setting

Goal Setting Communication Skills

Communication Skills

Dream Job

Dream Job E-Learning

E-Learning Career Mapping

Career Mapping Online Self Assessment

Online Self Assessment